Loading

CMSAX | CMSIX

Altegris/Crabel Multi-Strategy Fund

Altegris/Crabel Multi-Strategy Fund -

Investment Approach

The Fund's investment objective is to seek long-term capital appreciation by allocating its assets among multiple investment strategies, as described below, with a goal of delivering an “all weather” solution that has the potential to provide positive returns in all market environments.

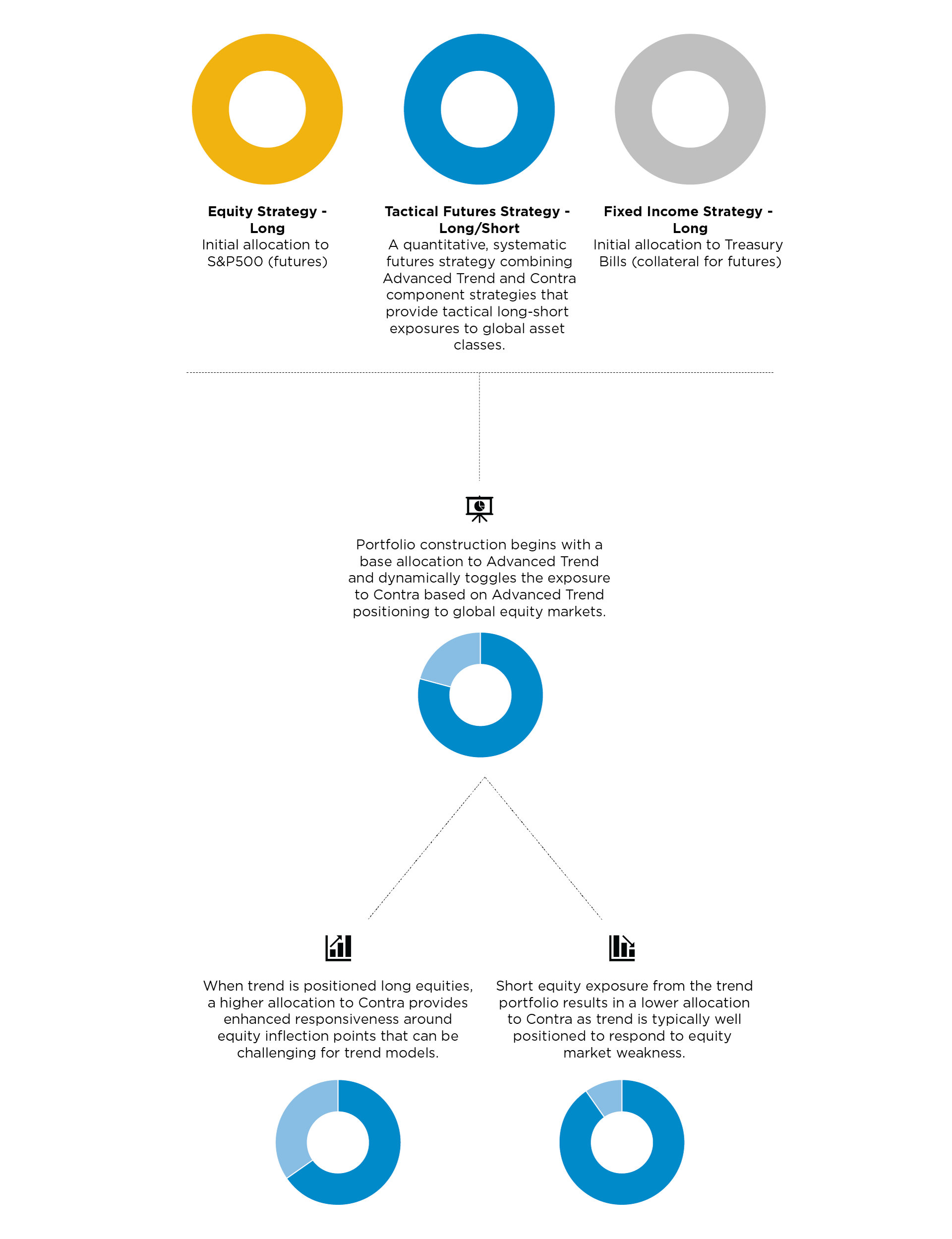

Tactical Futures Strategy: Tactical Futures is a long-short strategy that seeks to deliver long term capital appreciation through trend following exposure with defensive positioning designed to provide rapid responses to declines in equity markets. The Tactical Futures strategy is implemented as a combination of two component strategies: (i) “Advanced Trend” and (ii) “Contra”.

Equity Strategy: The Equity strategy seeks to provide the Fund with long-term, strategic exposure to U.S. and non-U.S., primarily liquid equity securities of issuers across both developed and emerging market countries, and is implemented on a relatively passive, long-only, “buy-and-hold” basis.

Fixed Income Strategy: Fund assets not allocated to the Tactical Futures and Equity strategies will be invested in long-only fixed income investments with aim of adding diversification to the returns generated by the Tactical Futures and Equity strategies and generating potential additional income and capital appreciation.

The use of fixed income investments as collateral to support futures positions in the Tactical Futures and Equity strategies allows the Fund to gain multi-strategy exposure in excess of 100% of its net asset value.

Investing involves risk, including loss of principal. There is no guarantee that any investment strategy will achieve its objectives, generate profits or avoid losses. Derivatives Risk: Futures, options and swaps involve risks different from, or possibly greater than the risks associated with investing directly in securities including leverage risk, tracking risk and counterparty default risk in the case of over the counter derivatives. Option positions may expire worthless exposing the Fund to potentially significant losses. Fixed Income Risk: When a fund invest in fixed income securities or derivatives, the value of your investment in the fund will fluctuate with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of fixed income securities or derivatives owned by a fund.

Sub-Adviser

Crabel Capital Management was founded in 1987 by Toby Crabel. Using decades of experience in research, technology, and quantitative trading, Crabel has developed several unique absolute return programs that serve as liquid, transparent, and diversified investment options for institutional clients.

With a vision to define quantitative finance, Crabel combines award-winning experience with data science and leading-edge technology to provide systematic trading programs in line with four core philosophies.

Philosophy #1

Research and Alpha Discovery

Crabel seeks to identify persistent, explainable market anomalies across a wide range of instruments and employs a testing methodology for each trading idea. Their short-term trading concepts are designed to exploit behavioral inefficiencies across a variety of different market environments.

Philosophy #2

Trading and Execution

Crabel makes significant investments in low latency execution infrastructure, measures trade execution speed in microseconds, and minimizes costs to reduce alpha erosion as trade implementation is of equal important to the trade concept itself.

Philosophy #3

Risk Management

Crabel focuses on capital preservation through automated comprehensive risk limitations in every portfolio, as each has an annual volatility target and multiple layers of risk controls at the position and position levels

Philosophy #4

Operational Excellence

Crabel seeks constant innovation and continuous improvement to avoid alpha decay, collaborating across teams to elevate strategy research, algorithm execution development, and technological integration.

Target Fund Exposure 1

As of most recent prospectus

Historically uncorrelated component strategies combine to target all-weather participation.

No level of diversification or non-correlation can ensure profits or guarantee against losses.

Managers

.png)

Biography - Michael Pomada

Michael Pomada is President and Chief Executive Officer of Crabel Capital Management. He is also a member of the firm’s Leadership and Executive Committees.

Serving as the the Portfolio Manager of Crabel Gemini and Crabel Contra, Michael also developed Crabel Advanced Trend.

Prior to joining Crabel, Michael spent time at UBS and managed portfolios at Manchester Trading (Niederhoffer) and Coast Asset Management. He began his career in sales and business development in the interactive entertainment industry before transitioning into finance. A graduate of the University of California, Berkeley, Michael also holds an MBA with a concentration in investments and statistics from the University of Southern California.

Shortly after joining Crabel in 2008, Michael spearheaded a firmwide initiative to revamp the organization’s trading infrastructure, execution process, and microstructure research. Today, he spends his time on research, product development, and front office oversight.

Firm Overview

Biography - Matt Osborne

Matt Osborne is the Chief Executive Officer (CEO), Chief Investment Officer (CIO) of Altegris, a provider of premier alternative investment solutions, where he oversees the firm's investment research, product structuring, and portfolio strategy team.

Prior to founding Altegris in 2002, Osborne was the director of research for the managed investments division of Man Financial, with responsibility for manager selection and research. Previously, Matt had a 12-year career with a prominent family investment office in his native New Zealand. In his role as senior investment manager, Osborne was responsible for formulating investment policies and implementing a global asset allocation program that focused on alternative investments, including hedge funds, managed futures, private equity, and real assets.

Osborne has significant trading expertise in equities, fixed income, foreign currencies, global futures, and options, among other securities. Matt currently holds FINRA Series 3, 7, 24, and 63 licenses.

Firm Overview

Altegris

Based in La Jolla, CA, Altegris was founded in 2002 and has continued to focus solely on alternative asset managers and strategies, because a sophisticated investment portfolio should not rely on stocks and bonds alone. Altegris builds actively managed investment solutions designed to help advisors, institutions and individual investors achieve greater alpha, lower their risk, and improve portfolio diversification. Altegris provides investors with access to innovative investment strategies through our proprietary research, sourcing, and structuring.

.png)

Biography - Grant Jaffarian

Firm Overview

Documents

Product

Fact Sheet: Quarterly

Legal and Compliance

CAREFULLY CONSIDER THE FUND'S INVESTMENT OBJECTIVES, RISKS, CHARGES AND EXPENSES AS DETAILED IN ITS PROSPECTUS AND SUMMARY PROSPECTUS, WHICH CAN BE OBTAINED BY CALLING (888) 524-9441. READ THE PROSPECTUS CAREFULLY BEFORE INVESTING.

Funds are distributed by Northern Lights Distributors, LLC Member FINRA/SIPC. Altegris Advisors and Northern Lights Distributors, LLC are not affiliated.

Important Risk Disclosures

THE FUND MAY NOT BE SUITABLE FOR ALL INVESTORS

Investing involves risk, including possible loss of principal. You may have a gain or loss when you sell shares. There can be no assurance that the Fund will achieve its investment objectives. The Fund’s investments in commodity futures markets are volatile, as commodity futures prices are influenced by unfavorable weather, geologic and environmental factors, regulatory changes and restrictions. Trading and investing on non-US exchanges and in non-US markets poses additional risks as compared to trading and investing in the U.S., due to currency fluctuation, adverse political or economic conditions, and differing audit and legal standards (risks that are magnified for investments in emerging markets). The Fund will invest in futures, swaps, structured notes, options and other derivative instruments, which are leveraged and can be more volatile. less liquid, and subject to the Fund to increased costs, as compared to traditional investments. Derivatives may also be subject to increased tracking risk, risk of counterparty default, adverse tax treatment. The Fund will leverage investments to the extent permitted by its investment policies and applicable law, and the managed futures programs it accesses will be traded with additional notional funding – all of which will magnify the impact of increases or decreases in the value of Fund investments and cause the Fund to incur additional expenses. Futures contracts are generally liquid, but under certain market conditions there may not always be a liquid secondary market. The Fund’s use of short selling and taking short positions in derivatives involves increased risks and costs, as the Fund may pay more for an investment than it receives in a short sale, with potentially significant and possibly unlimited losses. The Fund’s investment in ETFs or other investment funds will subject it to the risks and expenses affecting those funds. The Fund invests in fixed income securities, including preferred stock, and their values typically fall when interest rates rise. Fixed income securities are subject to the issuer’s credit risk, risk of default and prepayment risk in the case of mortgage-backed and similar securities. Below investment grade and lower quality high yield or junk bonds present heightened credit risk, liquidity risk, and potential for default. Investing in defaulted or distressed securities is considered speculative. REITs are subject to market, sector and interest rate risk. The Fund is non-diversified and can invest a greater portion of its assets in securities of the same issuers than a diversified fund, and therefore a change in the value of a single security could cause greater fluctuation in the Fund’s share price than would occur if it were diversified. The Fund trades actively, which can increase volatility and costs due to high turnover.

The Fund is a new mutual fund (Dec 31, 2022) and has a limited history of operations for investors to evaluate. Investors in the Fund bear the risk that the Fund may not be successful in implementing its investment strategies, may be unable to implement certain of its investment strategies or may fail to attract sufficient assets, any of which could result in the Fund being liquidated and terminated at any time without shareholder approval and at a time that may not be favorable for all shareholders. Such a liquidation could have negative tax consequences for shareholders and will cause shareholders to incur expenses of liquidation. Mutual funds and their advisers are subject to restrictions and limitations imposed by the Investment Company Act of 1940, an amended and the Internal Revenue Code that do not apply to the Adviser’s management of individual and institutional accounts. As a result, the Adviser may not achieve its intended result in managing the Fund.

ALTEGRIS ADVISORS

Altegris Advisors LLC is a CFTC-registered commodity pool operator, NFA member, and SEC-registered investment adviser that sponsors and/or manages a platform of alternative investment products.

INDEX DESCRIPTIONS

The referenced indices are shown for general market comparisons and are not meant to represent any particular Fund. An index is unmanaged and not available for direct investment.

ICE BofA Merrill Lynch 3-month T-Bill Index. An unmanaged index that measures returns of three-month Treasury Bills.

GLOSSARY

Alpha. A measure of performance, indicating when a strategy’s performance exceeds a market index or benchmark that is considered to represent the market’s movement as a whole.

S&P 500 Futures. A type of futures contract that provides buyers with an investment price based on the expectation of the S&P 500 Index's future value. A futures contract is a legal agreement to buy or sell a particular asset or security at a predetermined price at a specified time in the future.

Investment grade. A credit rating that is in one of the top categories by Standard & Poor’s (BBB- or higher) or Moody’s (Baa3 or higher). Typically believed to have adequate to exceptional ability to pay interest and repay principal.

Long. Buying an asset/security that gives partial ownership to the buyer of the position. Long positions profit from an increase in price.

Short. Selling an asset/security that may have been borrowed from a third party with the intention of buying back at a later date. Short positions profit from a decline in price. If a short position increases in price, the potential loss of an uncovered short is unlimited.

5203-NLD-02/09/2023